A Complete Guide to BBMP Property Tax

Bruhat Bengaluru Mahanagara Palike (BBMP) levies an annual Property Tax on property owners in Bengaluru. It is paid to the municipal authority to fund infrastructure development, maintenance of civic amenities, and services like waste management, water supply, and road upkeep in the city.

Who is required to pay the BBMP property tax?

Owners of any residential, commercial or industrial property within the BBMP limits are required to pay the property tax every year.

How is BBMP property tax calculated?

The BBMP property tax rate is 20% of the taxable value of the property. Get an estimate of your property tax amount using our BBMP Property Tax Calculator

Taxable value of the property = Built up area x UAV x 10 months

- Built up area refers to the total area covered by building/buildings including all covered area like basement, mezzanine flooring, balcony whether covered or not; and garage area.

- Unit Area Value (UAV) is the rate per square feet defined by BBMP for a property based on the following

- BBMP specified zone that the property falls under. The zones are defined on the basis of property guideline value

- Whether the property is occupied by the owners or tenants

- Type of roofing and flooring

- BBMP considers only 10 months for the calculation of the taxable value, with a two months deduction is given to allow for for repair or maintenance of the building.

Once the taxable value is calculated, the property tax applicable is 20% of this value.

An additional cess of 26% is applied over the property tax value. The cess charges include Health Cess, Library Cess and Beggary Cess.

What is the due date for BBMP property tax payment?

The last date for payment of property tax is March 31st for the assessment year. The tax can be paid in two instalments. However, payment of the entire amount before July 31st makes the owner eligible for a 5% rebate.

Are there any rebates or discounts available?

A 5% rebate is offered to property owners who pay their property tax early in the year.

Property owners may also claim a discount against depreciation in property value once every three years.

How can BBMP property tax be paid?

Owners can pay the BBMP property tax online or offline at BBMP designated centres. Landeed helps property owners in making property tax payments smoothly.

To pay the property tax, the following details are required:

- Owner's name

- The unique SAS Application number assigned for their property. This is available on the previous tax payment receipt.

- An OTP from the phone number linked to the property is needed at the time of making the payment.

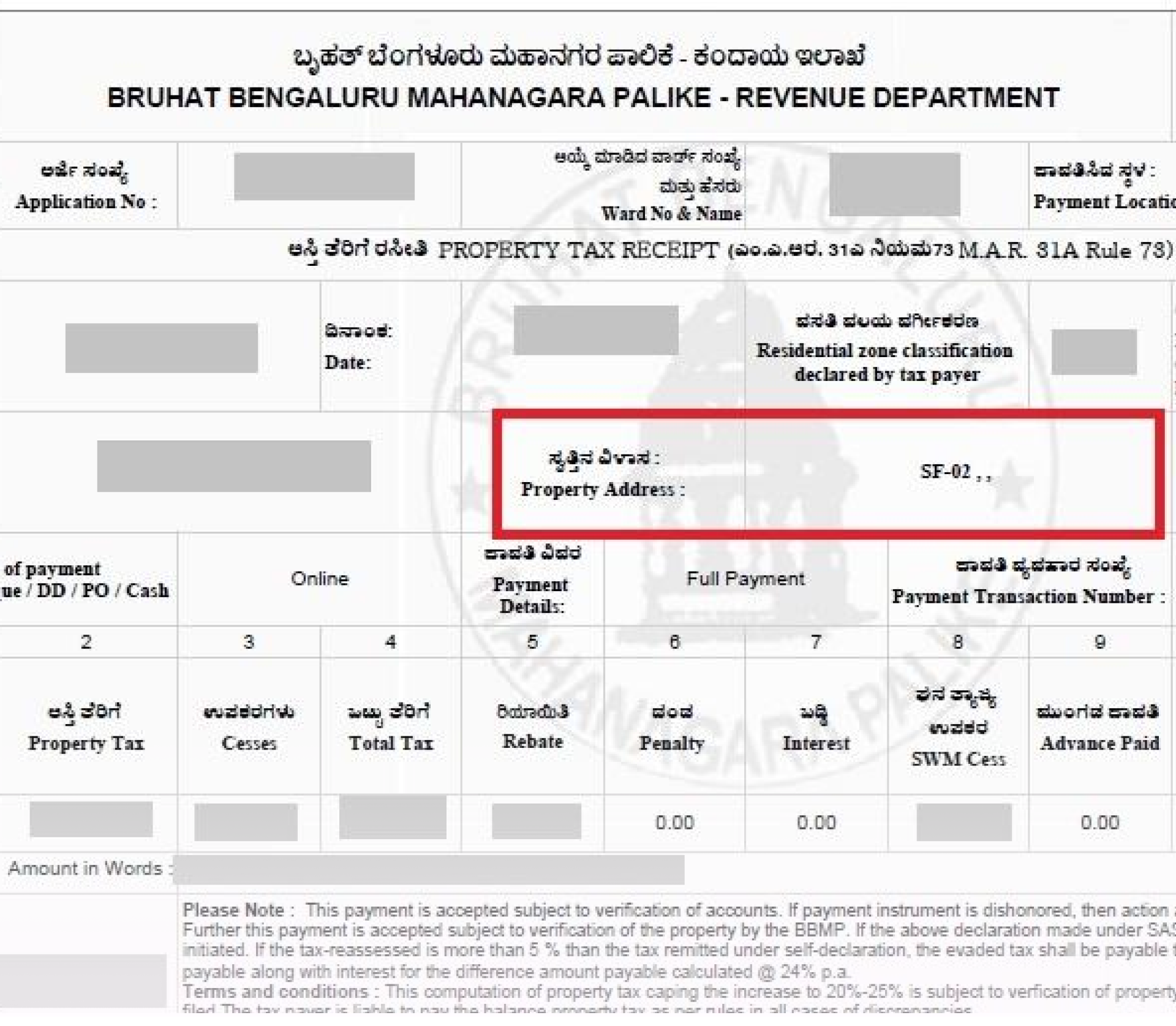

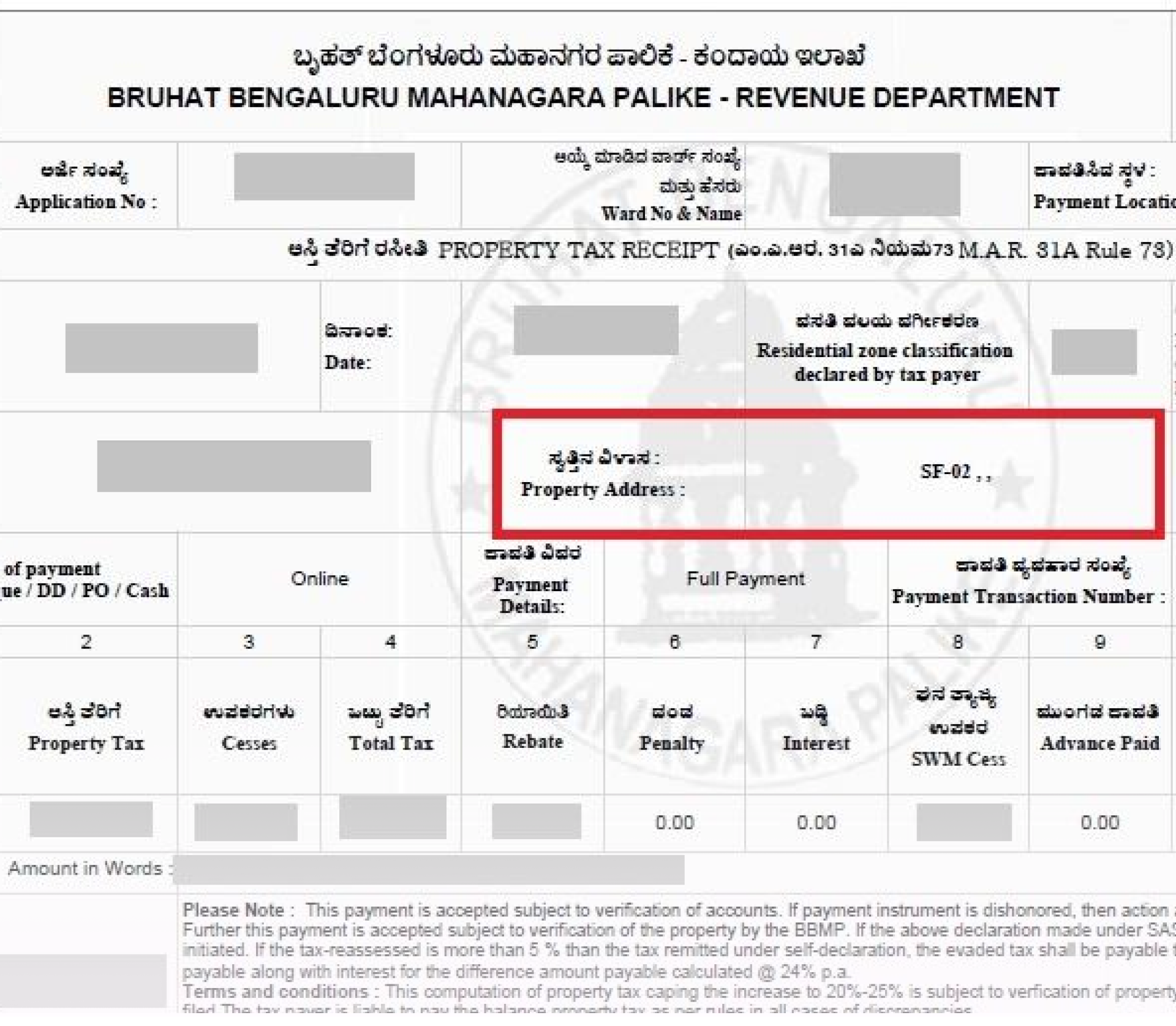

BBMP Property Tax ReceiptWhy is paying property tax essential?

Property tax receipts act as a proof of property ownership and can be used for strenghtening the owner's claim, especially in case of disputes. You can procure the property tax receipt quickly using Landeed

Clearing property taxes is also a prerequisite for

- Transferring ownership including sale of property

- Applying for loans or mortgages

- Applying for e-khata for the property

What are the consequences of not paying property tax?

Failure to pay the applicable property tax can lead to several serious consequences.

BBMP imposes a penalty of 2% per month on unpaid property tax, which accumulates over time. This increases the total payable amount significantly if not cleared promptly. They may issue demand notices to defaulters, asking them to pay the outstanding amount within a stipulated time and proceed with legal action.

In extreme cases of prolonged non-payment, BBMP has the authority to attach or auction the property to recover the dues, does leading to loss of ownership of the property.

Conclusion

Property taxes are an important part of property ownership and should be paid annually. Property tax payment receipts act as a proof of ownership of the property.